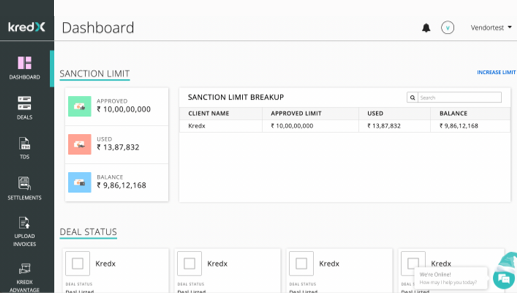

Helping Business Owners since 2015

1.5 Million

Invoices Discounted

5

Countries Served

USD 10 Billion

Transaction Volume Till Date

40,000+

Businesses Helped

70,000+

New & Returning Investors

300+

Corporates on KredX Platform

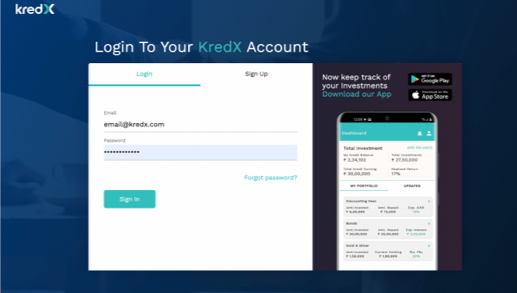

Release Your

Locked Cash

With KredX invoice discounting platform, you no longer have to wait for several days to get paid for your goods and services. Use your company's unpaid invoice as collateral to get instant cash for your business expansion.