Bill Discounting

Most businesses provide credit facilities to their customers to boost sales and build brand loyalty. However, the issue arises when a significant amount of money is stuck in bills receivable— impacting the working capital required to pay operating expenses. If credit is not given wisely, there will be a huge discrepancy between the cash inflow and outflow of the business.

Table Of Contents :

3) Advantages of Bill Discounting

4) Disadvantages of Bill Discounting

5) Bill Discounting Interest Rates

6) Bill Discounting Versus Business Loan

7) Difference Between Bill Discounting and Invoice Discounting

Therefore, it is imperative for any business to make sure working capital remains unaffected. Here comes bill discounting, an ideal option in the situation. Bill discounting is a financial practice where a bank or financial institution purchases a bill of exchange from the holder before its maturity at a discounted value. It allows the holder of the bill, typically a business, to obtain immediate funds by receiving a portion of the bill's face value upfront, minus the discount or interest deducted by the bank. Bill discounting service offered by KredX can help you access collateral-free, working capital to fuel your business requirements.

What Is Bill Discounting?

It is a trade-related activity in which a company’s unpaid invoices which are due to be paid at a future date are sold to a financier (a bank or another financial institution).

In bill discounting, the business trades the company's unpaid invoices to gain access to short-term financial assistance and maintain the working capital. It is most pertinent in cases when a buyer purchases goods from the seller, and the payment is made through a letter of credit. This process is also called “Invoice Discounting”. This process is governed by the negotiable instrument act, of 1881.

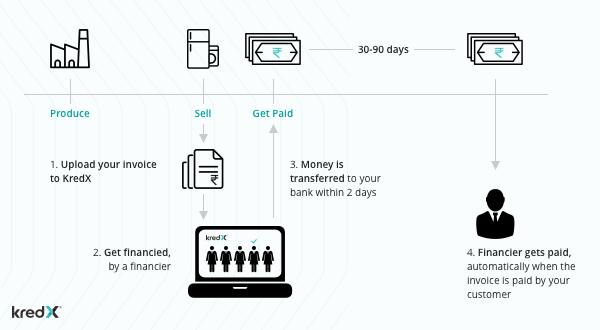

Bill Discounting Process

KredX is a leading bill discounting platform that allows businesses to trade their invoices digitally for quick access to short-term funds.

The bill discounting process is transparent and simple. It includes the following steps:-

- The Business generates an invoice (usually payable within 30 to 90 days) from the date of sale.

- Business visits the KredX website and uploads the unpaid invoice digitally.

- Investors in the KredX platform purchase the invoice at a discounted rate.

- The invoice value offered by the investor will be transferred to the business account within 24 to 72* hours upon approval.

- The business receives the funds and facilitates the working capital.

Advantages of Bill Discounting

Bill discounting is advantageous to businesses, banks, finance companies, and investors. Businesses benefit by rejuvenating their cash-flow in-turn helping them stabilize growth and fund business expenditure.

Cash Flow Improvisation

Businesses being dependent on the cash flow to sustain their business can easily rely on this quick financial aid to access speedy funds and continue to flourish. This process quickens money inflow— profiting the organization in expanding deals, seeking after development, securing hardware, etc.

Instant Access to Cash

Bill discounting is a more efficient, faster way of assessing working capital as it is hassle-free and does not involve lengthy documentation procedure. With KredX, businesses can secure financial assistance in just 24 to 72* hours.

No Collateral Involved

There is no requirement to keep any asset as security as the unpaid invoice is considered as the collateral itself.

No Debt Incurred

Bill discounting helps in saving tax liability. The chances of a company suffering any loss or damage are almost nonexistent when compared to conventional financing frameworks.

No Impact on the Business Sheet

The bill discounting service offered by KredX does not impact the balance sheet of the business as it is an off-the-book process.

Disadvantages of Bill Discounting:

- Invoice discounting reduces the investor’s gross profit margin as the bank deducts a huge amount as a fee while discounting bills.

- Most financial institutes discount only commercial bills.

- It cannot be thought to be a long term solution for finance as is only a source of short-term fund arrangement.

- New businesses might not be eligible.

Bill Discounting Interest Rates

The interest rates are decided based on many factors such as the risk factor, and the financial institute. The business will get a better rate if they choose a reputable platform. Invoice discounting interest rates are declining from the last two years and more MSMEs are availing aid rather than approaching for a loan.

Bill Discounting Versus Business Loan:

|

Bill discounting |

Business loan |

|

Collateral-free finance |

Collateral required |

|

Quick processing (Usually in a couple of days) |

Long processing period |

|

Availed of short-term financial aid |

Availed long-term financial assistance |

|

Digital process |

Generally not a digital process |

|

Hassle-free documentation process |

Lengthy documentation process |

|

Simple eligibility criteria |

Stringent eligibility requirements |

|

No impact on the business balance sheet |

Impacts the business balance sheet and is considered a debt |

Difference Between Bill Discounting and Invoice Discounting

The major difference between bill discounting and invoice discounting is the loan tenure. Businesses can avail of financial assistance for shorter tenure usually up to 90 days against unpaid invoices with invoice discounting. Whereas in bill discounting, the tenure ranges from 30 to 120 days.

Eligibility Criteria:

- The business should be a minimum of 10 months old

- Should have dealt with at least 2 large-scale corporates

- Credit score should be 650 or more

- The business ought to have a base turnover of 25 lakhs

Documents Required:

The following documents mentioned are required to apply for bill discounting in India:

Pre-assent Phase:

- KYC of applicant/co-applicant

- CIBIL record of directors

- Address proof and PAN Card copy

- GST registration certificate and returns

- Bank statement records 6/12 months

- Books of audited financials

- Loan Declaration

Post-asset Phase:

- Board Resolution

- Post-dated cheque

- Letter and Memorandum of Association

- A Guarantee letter

- Articles of association

Who Can Go For Bill Discounting?

In a broader sense, small and medium-sized companies may find bill discounting as an ideal way to boost liquidity. Businesses that are low on liquidity and lack immediate funding, often resort to bill discounting to finance their purchase of raw materials and clearing off pending orders.

Other than these, businesses that intend to provide a more extended credit period to customers to sustain market competition can choose this funding option to keep operating activities continuous.

When Should We Go For Bill Discounting?

If at any time a business has to meet any of these following needs, they can fulfill the same by opting for bill discounting –

To Boost Cash Flow

Bill discounting is a viable option to inject cash into the operational stream of a business. It helps entrepreneurs to replenish their cash flow and increase immediate liquidity quickly.

For Freeing Tied-Up Working Capital

This funding option allows businesses to free tied-up capital and in turn, eliminate the need of applying for a loan. Moreover, it also proves useful in shortening the working capital cycle.

To Settle Debts

If at any time businesses have to pay their suppliers, but their working capital is significantly low, they can get their bills discounted. With the funds availed, they can pay their suppliers and other immediate liabilities.

Other than these, businesses can also get bill discounting services if they need immediate funding but do not wish to provide any security to avail of it.

FAQs

In bill purchasing the whole amount is credited to the individual’s account by the finance institute after the purchase, the seller receives the whole amount of the bill as opposed to invoice/bill discounting, and the bank gets the commission. Read More

Electronic bill discounting is a concept by the Financial Sector Reform (FSR) Committee, SIDBI, and NSE to support the financing of MSME receivables. There are several bill discounting platforms online. KredX is one of the leading invoice discounting platforms in India.

Bills discounted but not matured are in most cases considered contingent liabilities as the drawer may not be sure whether the bill will be honored at maturity. If the bill is not honored at maturity, it becomes a liability. In this case, the drawer becomes liable to repay the amount to the lender.

A Yes, it is eligible for tax benefits as it does not deduct tax at source.

Bills discounted are considered to be a liability.

Although they are both financing options leveraged by an asset, there is an important distinction worthy of mentioning. With regard to bill factoring, the investor or the finance company owns the sales ledger. In this case, the investor holds the responsibility of collecting the due invoices from the customer. However, in bill discounting, the company itself bears the right to make the collection.

Yes, factoring includes bill discounting, but the customer knows that the invoices have been factored in. The provider assumes the responsibility of handling the sales ledger

Can I choose which invoices to discount?

Yes, businesses have the flexibility to choose which invoices they want to discount based on their funding needs.

How long does the bill discounting process take?

The time taken varies, but it can generally take a few days to a couple of weeks to complete the process and receive funds.

How much discount can I expect on my bills?

The discount offered depends on factors such as the creditworthiness of the business, invoice quality, and prevailing market conditions. Discounts typically range from a certain percentage of the invoice value.

Yes, businesses have the flexibility to choose which invoices they want to discount based on their funding needs.

The time taken varies, but it can generally take a few days to a couple of weeks to complete the process and receive funds.

The discount offered depends on factors such as the creditworthiness of the business, invoice quality, and prevailing market conditions. Discounts typically range from a certain percentage of the invoice value.