Permanent And Temporary Working Capital

Working capital is the primary component (before permanent working capital) when it comes to a business’s operational competency and growth potential. Managing it efficiently not only ensures that short-term requirements are met adequately but also sets the stage for achieving long-term objectives more efficiently. So, when running a business, it is essential to understand the concept and ways to manage it effectively.

Table Of Contents :

1) Difference Between Working Capital Types

Working capital is defined as the difference between a company’s assets and liabilities. Hence, with adequate working capital, you can meet all short-term expenses and liabilities in your business efficiently. You can address financial emergencies with greater ease when there’s sufficient working capital.

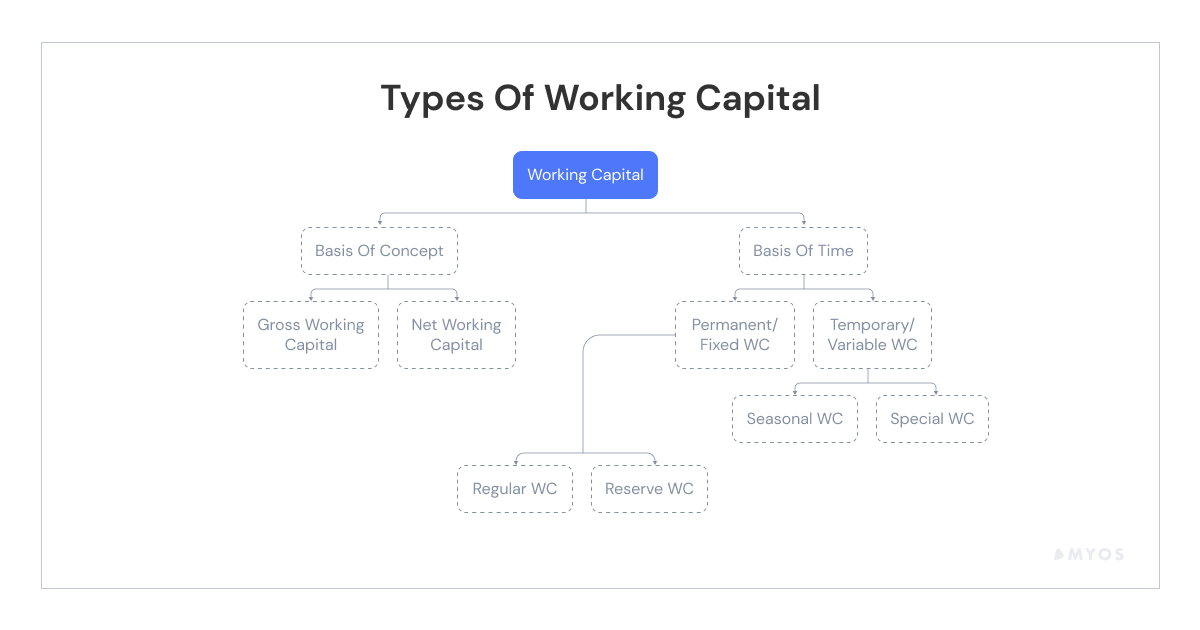

Based on periodicity, any business basically requires two primary types of working capital to finance its operations –

- Permanent working capital

- Temporary working capital

Source: Myos

Difference Between Working Capital Types

1. Permanent Working Capital

Permanent working capital also known as fixed working capital, this type of working capital is constant throughout business operations. Also known as fixed working capital, companies need to maintain such an amount to meet their basic financial requirements, like paying rent & salaries, repaying creditors, et al. The amount, thereby, to maintain in your company depends on its size and scale of operations.

While permanent working capital is a broader term, its classification provides a more nuanced understanding of it.

- Regular Working Capital

There are certain expenses in your business that you cannot do without. For instance, in the case of a manufacturing business, there’s a constant monetary need to fund the processing of raw materials. The minimum amount required to finance expenses of that kind is called regular working capital.

- Reserve Margin Working Capital

Sudden financial obligations may arise due to unprecedented circumstances in any business. That may include natural calamities, changes in government policies, etc. Reserve margin working capital is for this purpose.

However, not always does reserve margin working capital suffice such unprecedented financial needs. In that case, you might look for alternative financing options, such as invoice discounting service from KredX.

How to Calculate Permanent Working Capital?

Are you looking for an official permanent working capital formula to calculate? Unfortunately, there isn’t one.

But don’t worry, you need not scratch your head to find the permanent working capital required for your business.

Here’s how to find permanent working capital (Formula for Working Capital) -

- Determine the net working capital of your company for each day.

- Make a list of net working capital's daily values next. Find the least number after you get that list. That will serve as your month's fixed working capital. Do that now for every month. You can monitor the changes in your annual permanent working capital levels to see how they correspond to other factors influencing the expansion of your company.

It should be noted that this figure will alter as your business expands and as its assets and liabilities alter. Whatever the precise monetary number, it is still true that if your company's capital were to fall below the fixed working capital

2. Temporary Working Capital

Also known as variable working capital, it is the excess amount a business needs over and above its permanent counterpart. It is related to the volume of production in a business. Since sales and production fluctuate throughout the year, working capital requirements may also vary. It can be classified into two types.

These are:

- Seasonal Capital

Production and sales largely depend on the season. In specific seasons, a company might not make much higher sales compared to the rest of the year. For instance, if you own a clothing business, there will be massive demand during the festive seasons. Seasonal working capital is the amount required to fund that kind of demand.

Since in such seasons, there’s a massive cash outflow in the form of purchasing raw materials, paying distributors, etc. several businesses opt for financing services like invoice discounting, bank loans, etc.

- Special Variable Working Capital

It is the amount of capital a business needs to mitigate exceptional financial obligations, like a sudden demand for PPE kits. It can also include launching a sudden marketing campaign because of moves by competitors.

These are the different types of working capital that you may need in your company. Understanding “what is working capital” in depth can facilitate better management of the same.

Conclusion

When your company starts to expand, the need for working capital will also change. However, your company will always need to have enough working capital on hand to satisfy its needs. So, now is the perfect moment to organize your company's finances so you can determine your permanent working capital and make sure you don't fall below it.

FAQs

A. There’s no hard and fast rule for that. You can determine it based on the minimum level of production or sales you carry out and the associated expenses for that.

A. The primary factors that determine the amount of working capital you will need in your business are –

- Size of the business

- Nature of the business

- Cash conversion cycle

- Production cycle

- Seasonal demand

A. Every firm, irrespective of their size must practise active working capital management as it helps them to keep their operations running smoothly. It further improves earnings and ensures sustainability.

A. There are 3 methods of forecasting or estimating the future working capital of a firm. They are - the percentage of sales methods, operating cycle method and regression analysis method.