Zero Working Capital

Table Of Contents :

2) Importance of Working Capital for Business Growth

As an entrepreneur, individuals must make it a point to become familiar with the relatively new concept – zero working capital – for more clarity over the situation.

What Is Zero Working Capital?

Usually, when an enterprise has the same amount of current assets and current liabilities, it has zero working capital. Such a situation arises when a company’s current liabilities fully fund its current assets, as highlighted in the table below:

Total Current Assets = Total Current Liabilities

or,

Total Current Assets – Total Current Liabilities = 0

Example Of Zero Working Capital

Take a look at this example below to understand the concept of zero working capital.

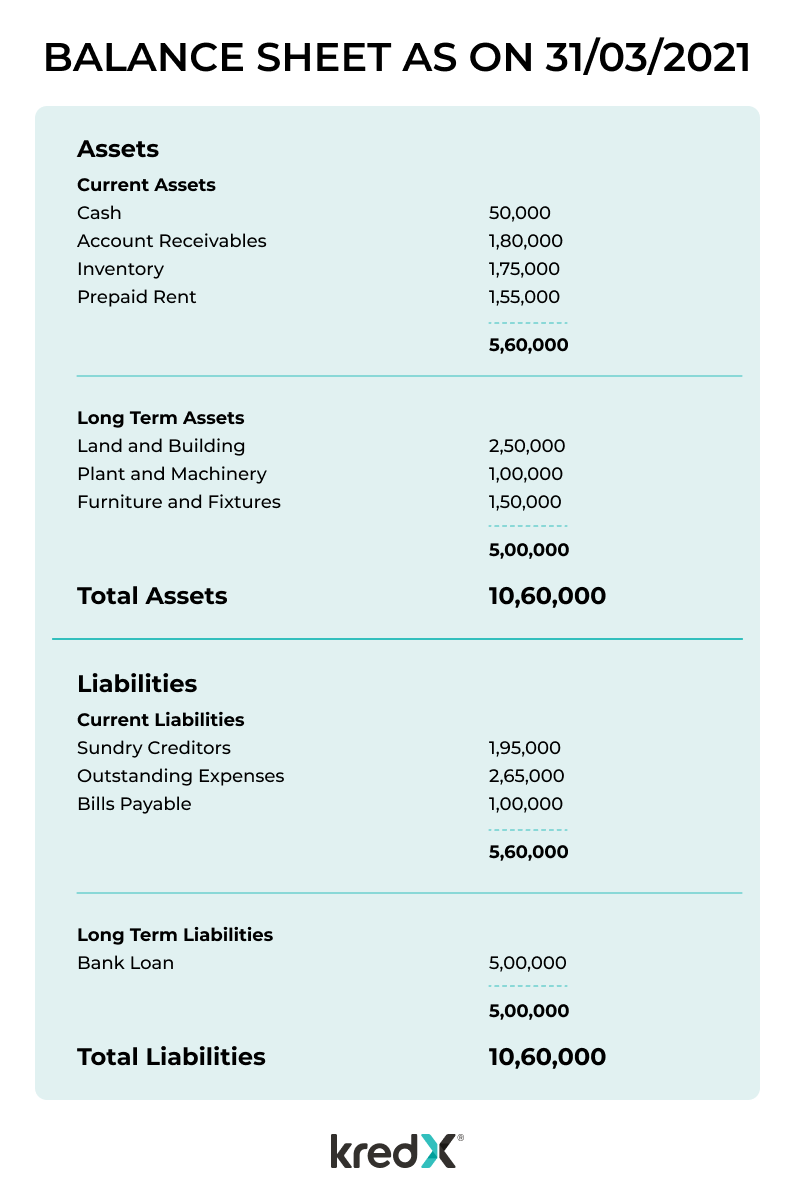

Suppose a company, ABC Ltd., has the following balance sheet for the year ending on 31 March 2021.

Using the data given above, one can calculate working capital in the following manner:

-

Total Current Assets = Cash + Account Receivables + Inventory

+ Prepaid Rent

= Rs. (50,000 + 1,80,000 + 1,75,000 + 1,55,000)

= Rs. 5,60,000 -

Total Current Liabilities = Sundry Creditors + Outstanding

Expenses + Bills Payable

= Rs. (1,95,000 + 2,65,000 + 1,00,000)

= Rs. 5,60,000

Therefore, as ABC Ltd. does not have an excess of current assets over its current liabilities, it has zero working capital.

Benefits Of Zero Working Capital:

If an enterprise can maintain zero working capital without incurring excessive liquidity risk, it can benefit the firm’s operations in the following ways:

-

Reduces The Level Of Investments In Working Capital

Zero working capital is used as a strategy to reduce a company’s investment in working capital. As a result, it leads to an increase in its investment in long term assets. By following this strategy, a company can avoid excess investments in current assets and pay off its current liabilities using only its current assets. -

Facilitates The Just-In-Time Method

A zero working capital approach can only exist if a company adopts the “Just-in-time” methodology. It is an inventory strategy wherein materials are produced and supplied as and when a demand for them arises. Accordingly, the company can follow demand-based production as well as the distribution system.

In addition, the company gains the flexibility to modify its terms for account receivables and payables to keep up with the just-in-time practice. As a result, the company extends payable time granted by suppliers and cutback credit terms to its debtors. -

Saves Money Spent On Maintaining Inventory

A company running on zero working capital can outsource the entire manufacturing process. As a result, it can eliminate the maintenance of inventory, manufacturing facilities and overheads. Moreover, this enterprise will make payments to its outsourced manufacturer when its customers receive the goods and release payments. -

Reduces Overhead

Zero working capital centralises operations to eliminate account payables, thereby lowering overheads. For instance, a firm can lease machinery rather than purchasing it. Thereafter, it can fund the lease payment out of its account receivables.

Additionally, the strategy allows a company to strike partnerships with other firms for functional areas, using their resources to reduce expenditure on relevant heads.

Often companies are unable to maximise the perks induced by zero working capital. This is because achieving the said outcome in practice is not always possible.

Implementation Of Zero Working Capital

Although the concept may seem enticing, it is often challenging to achieve the same due to these reasons:

- Suppliers extend credit terms as per the industry standard and will only accept longer payment terms against higher product prices.

- Generally, customers do not pay in advance, an exception being consumer goods. In most cases, they refuse to make early payments. In some cases, they even demand delayed payment terms.

- A demand-based, just-in-time production strategy can be a complex concept for customers to comprehend in industries with high competition based on immediate fulfilment of orders.

- In the services industry, payroll essentially replaces inventory in the working capital concept. So, although there is no inventory, employees must be paid at regular intervals prior to customers making payments.

- Certain assets cannot be easily and promptly converted into cash when liabilities are due. Therefore, maintaining extra current assets is essential for a company to pay its bills on time.

So, optimum working capital plays a key role as it allows a company to undertake day to day operations and critical investment decisions. A shortage of working capital can, therefore, be detrimental to a business. Also, when faced with such a cash crunch, businesses can leverage their tied up accounts receivable from KredX.

KredX is a leading cash flow solution provider that helps to address operating capital requirements. It helps businesses gain quick access to funds in 24-72 hours* by way of an easy digital process. Moreover, one need not pledge any collateral to avail funds, thus unlocking liquidity to maintain a healthy cash flow balance.

FAQs

A company operating with a very high working

capital may indicate that it does not invest its

excess cash optimally. It can also denote that

this firm is neglecting its growth opportunities

and is solely focused on maximising liquidity.

In addition, an extremely high working capital may

imply that a business is overly invested in

inventory or that its collection of debts is

ineffective, thus highlighting operational

inefficiency and/or waning sales.

Companies employ this strategy to avoid excessive investments in current assets and pay off current liabilities by using their existing current assets only.

A company can reduce its working capital without jeopardising its ability to meet short-term obligations by adopting an on-demand production as well as distribution system or a just-in-time approach.