Payday Loans Vs Invoice Discounting: Which is Right for Your Business?

Navigating the complexities of business financing can be daunting, especially when choosing between payday loans and invoice discounting. Payday loans offer quick cash but often come with high costs, making them suitable for immediate, short-term needs. On the other hand, invoice discounting provides a more sustainable approach to cash flow management, leveraging unpaid invoices without accruing new debt.

Payday loans are a form of short-term financing designed primarily for individuals needing immediate financial assistance. These loans are typically due on the borrower’s next payday, hence the name. While they provide quick cash access, they often come with high interest rates and are not generally suited for long-term financial solutions. This blog aims to guide businesses through these options, assessing their impacts on financial health and long-term sustainability. By understanding the nuances of each, companies can make informed decisions that align with their specific financial strategies and growth objectives.

What is Payday Loans

Payday loans are short-term, unsecured loans typically used to cover urgent cash needs. They come with high-interest rates and are expected to be repaid upon the next payday. While they offer quick access to funds, the steep costs and short repayment terms can be challenging for businesses, potentially leading to a cycle of debt.

Knowing Invoice Discounting

Invoice discounting, on the other hand, allows businesses to leverage unpaid invoices to secure funding. This option is particularly effective for managing cash flow and working capital needs. There are leading invoice discounting platforms that specialize in providing a streamlined process that converts your receivables.

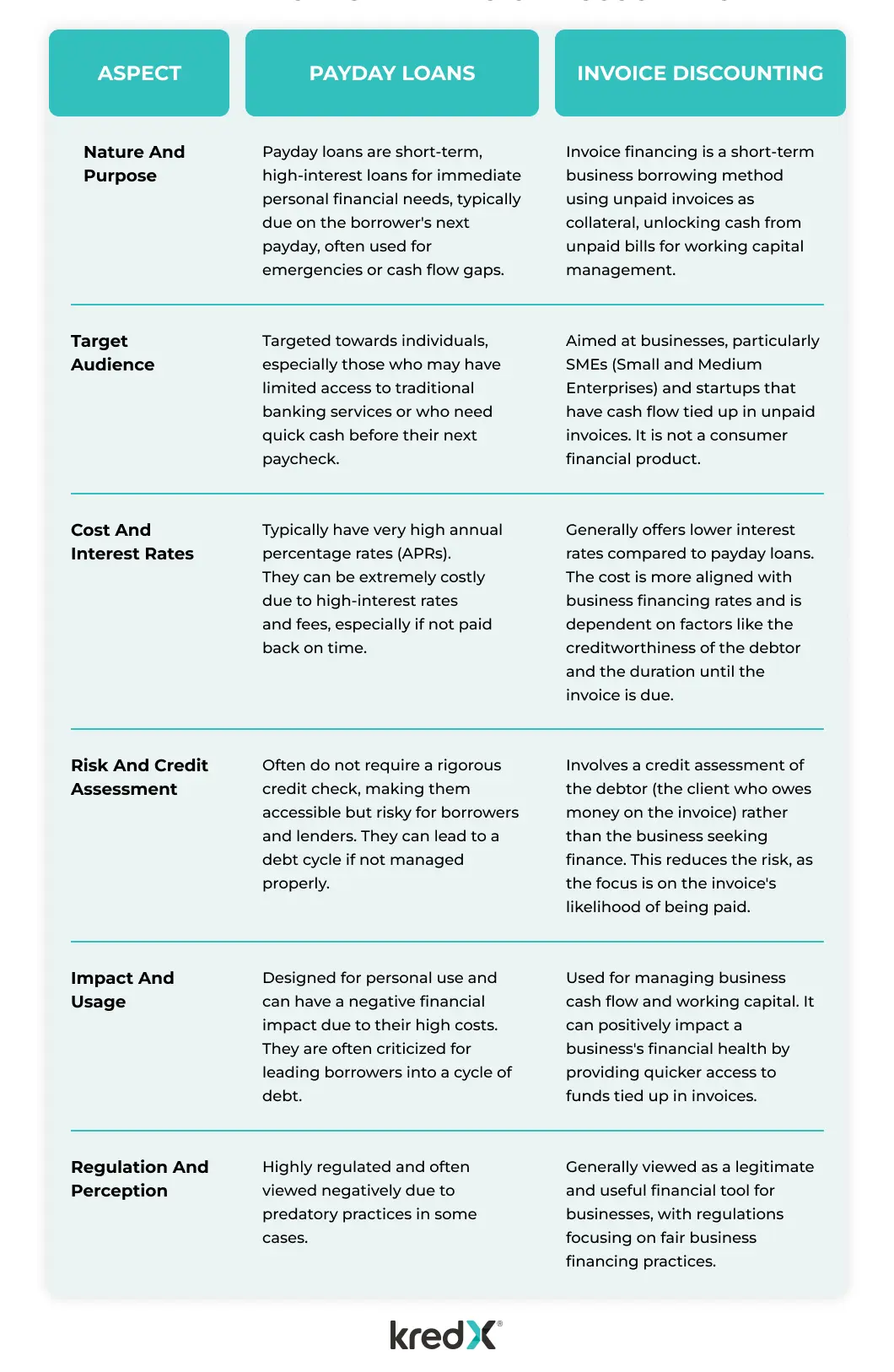

Difference Between Payday Loans and Invoice Discounting

The key differences between payday loans and invoice discounting lie in their nature, purpose, target audience, and overall financial impact. These two financial services cater to different needs and have distinct characteristics.

Making the Right Choice for Your Business

When selecting the most suitable financial solution, it’s crucial to align your choice with your business’s unique needs. If managing short-term cash flow effectively is a priority, consider invoice discounting as a superior option. This approach not only offers immediate liquidity by utilizing unpaid invoices but also ensures you retain control over your business finances. Unlike traditional loans or lines of credit, invoice discounting is a flexible and scalable solution, ideal for businesses seeking to maintain steady cash flow without the constraints of long-term financial commitments.

Always engage with financial advisors to get customized advice, ensuring that your choice, especially if it’s invoice discounting, complies with all regulatory standards. This strategy allows you to effectively manage cash flow while being adaptable to evolving business landscapes. Invoice discounting stands out as a strategic choice for businesses looking to balance immediate financial needs with long-term growth and stability.

Conclusion

Payday loans offer a quick fix, but their high costs can be detrimental to business’s financial health. If you’re looking for a way to enhance your business’s financial health, consider exploring well-known invoice discounting companies in India.