Udyog Aadhaar Registration – Why & How

Okay, so you’ve come up with a brilliant small business idea; you have a business plan, you’ve got the resources and your registration papers are in order. But, what about your Udyog Aadhaar Registration?

The MSME industry in India contributes to almost 40% of the gross industrial value. As a result of this, it has an extended support system from the central and state governments these days.

In an effort to further simplify the processes within the industry, the Udyog Aadhaar registration was introduced. The Udyog Aadhaar (UA) is nothing but an ID for your business much like the Aadhaar cards we have for individuals. It’s a 12-digit number that helps the government identify your company and gives you a slew of benefits under the MSMED Act of 2006. Previously, the UA registration was known under the names of SSI (Small Scale Industries) Certificate or MSME Registration.The SSI Certificate was renamed to Udyog Aadhaar with an easier one-page registration process instead of long time-consuming EM (Entrepreneurs Memorandum) I/II forms.

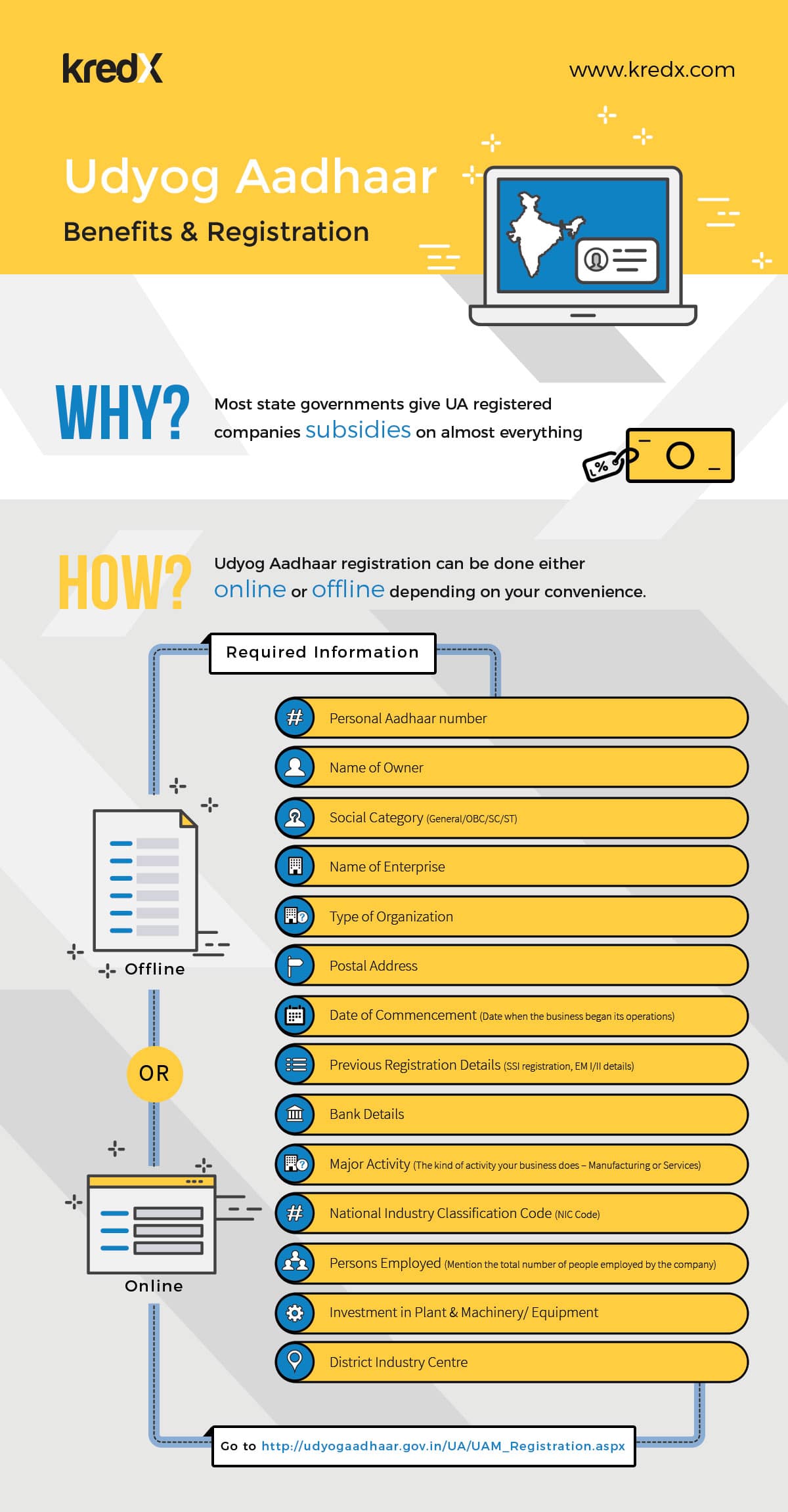

The Why

One word. Subsidies! Most state governments give UA registered companies subsidies on everything from power to tax and entry fees to industrial corridors and estates. Companies in its nascent years also get exempted from sales taxes, excise taxes and some direct taxes usually. Additionally, the central government announces schemes specifically targeted at micro, small and medium businesses from time to time such as the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS) that was announced recently. A UA registration also opens up a whole lot of benefits from banks. MSME’s get preferential rates of interest on loans, get quicker loan approvals, priority sector lending, etc.

Also, if you own a sole proprietorship firm, holding an Udyog Aadhaar acts as a proof that your business is legal in case you do not have VAT certificate or a Shop Act license. All you need to do is provide your UA as an ID proof for your company when applying for loans or opening an account with a bank.

Earlier, the Small Scale Industries Registration (SSI) was voluntary and as a result lot of MSME’s went unnoticed. With the introduction of UA, businesses choose to be registered due to the many benefits of being registered.

The How

Applying for a Udyog Aadhaar registration is fairly simple and straightforward. The single-page application is free and open to both new and existing companies. You can choose to apply for an UA either online or offline depending on your convenience. All you need are certain basic details such as:

- Personal Aadhaar number

- Name of Owner

- Social Category (General/OBC/SC/ST)

- Name of Enterprise

- Type of Organization

- Postal Address

- Date of Commencement (Date when the business began its operations)

- Previous Registration Details (SSI registration, EM I/II details)

- Bank Details

- Major Activity (The kind of activity your business does – Manufacturing or Services)

- National Industry Classification Code (NIC Code)

- Persons Employed (Mention the total number of people employed by the company)

- Investment in Plant & Machinery/ Equipment

- District Industry Centre

Once you enter these details, just click ‘Submit’ to generate the acknowledgment number and you’re good to go!

This is a great time for small businesses and enterprises alike due to the attractive schemes the government has for the MSME sector. As new and improved schemes are introduced, it becomes of utmost importance to have an Udyog Aadhaar registration.

While the government has been creating new avenues to help MSME’s on different fronts, funding and cash flow still remain issues to be resolved. Companies like KredX which is an invoice discounting marketplace aims to solve these hiccups in cash flow.

KredX is an Online Invoice Discounting Platform helping businesses address their cash flow issues.